Featured

Table of Contents

- – What is the process for getting Level Term Lif...

- – What is the best Affordable Level Term Life In...

- – What does Level Term Life Insurance cover?

- – How do I get Level Term Life Insurance Premiums?

- – How do I cancel Fixed Rate Term Life Insurance?

- – Level Term Life Insurance Protection

- – What does Level Term Life Insurance For Fami...

The major differences between a term life insurance policy plan and an irreversible insurance coverage (such as entire life or global life insurance policy) are the period of the policy, the buildup of a cash money worth, and the expense. The best option for you will depend upon your demands. Below are some points to take into consideration.

Individuals who own entire life insurance pay a lot more in premiums for much less insurance coverage yet have the safety of recognizing they are shielded forever. 20-year level term life insurance. People that purchase term life pay costs for an extended duration, however they get absolutely nothing in return unless they have the tragedy to die prior to the term ends

The performance of irreversible insurance policy can be constant and it is tax-advantaged, providing extra benefits when the supply market is unstable. There is no one-size-fits-all response to the term versus permanent insurance coverage dispute.

The motorcyclist ensures the right to convert an in-force term policyor one ready to expireto a permanent strategy without experiencing underwriting or showing insurability. The conversion biker should enable you to convert to any kind of irreversible plan the insurer uses with no constraints. The main features of the rider are keeping the original health rating of the term policy upon conversion (also if you later have wellness issues or end up being uninsurable) and choosing when and just how much of the insurance coverage to convert.

What is the process for getting Level Term Life Insurance For Families?

Naturally, general premiums will enhance substantially considering that whole life insurance policy is more pricey than term life insurance policy. The advantage is the ensured approval without a medical examination. Medical conditions that create during the term life duration can not create premiums to be enhanced. The firm may require limited or complete underwriting if you desire to add additional bikers to the new policy, such as a lasting care biker.

Entire life insurance policy comes with considerably higher month-to-month premiums. It is implied to offer insurance coverage for as lengthy as you live.

Insurance companies established an optimum age restriction for term life insurance coverage plans. The costs also increases with age, so a person aged 60 or 70 will certainly pay substantially even more than a person years more youthful.

Term life is somewhat similar to auto insurance coverage. It's statistically not likely that you'll need it, and the premiums are money down the drainpipe if you do not. If the worst occurs, your family members will receive the benefits.

What is the best Affordable Level Term Life Insurance option?

A degree premium term life insurance coverage plan allows you stay with your spending plan while you aid safeguard your family members. Unlike some stepped price plans that boosts yearly with your age, this kind of term strategy provides rates that remain the same for the period you choose, even as you get older or your health modifications.

Find out more regarding the Life Insurance options readily available to you as an AICPA participant. ___ Aon Insurance Providers is the trademark name for the brokerage and program management operations of Affinity Insurance coverage Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Firm, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Fondness Insurance Services, Inc.

What does Level Term Life Insurance cover?

The Plan Representative of the AICPA Insurance Trust Fund, Aon Insurance Solutions, is not affiliated with Prudential. Group Insurance policy insurance coverage is provided by The Prudential Insurance Provider of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

For the a lot of part, there are two sorts of life insurance coverage plans - either term or long-term strategies or some combination of both. Life insurance firms use different forms of term strategies and typical life policies as well as "rate of interest delicate" items which have actually become much more common since the 1980's.

Term insurance gives defense for a given amount of time - Level term life insurance vs whole life. This duration can be as brief as one year or offer insurance coverage for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes up to the oldest age in the life insurance policy mortality tables

How do I get Level Term Life Insurance Premiums?

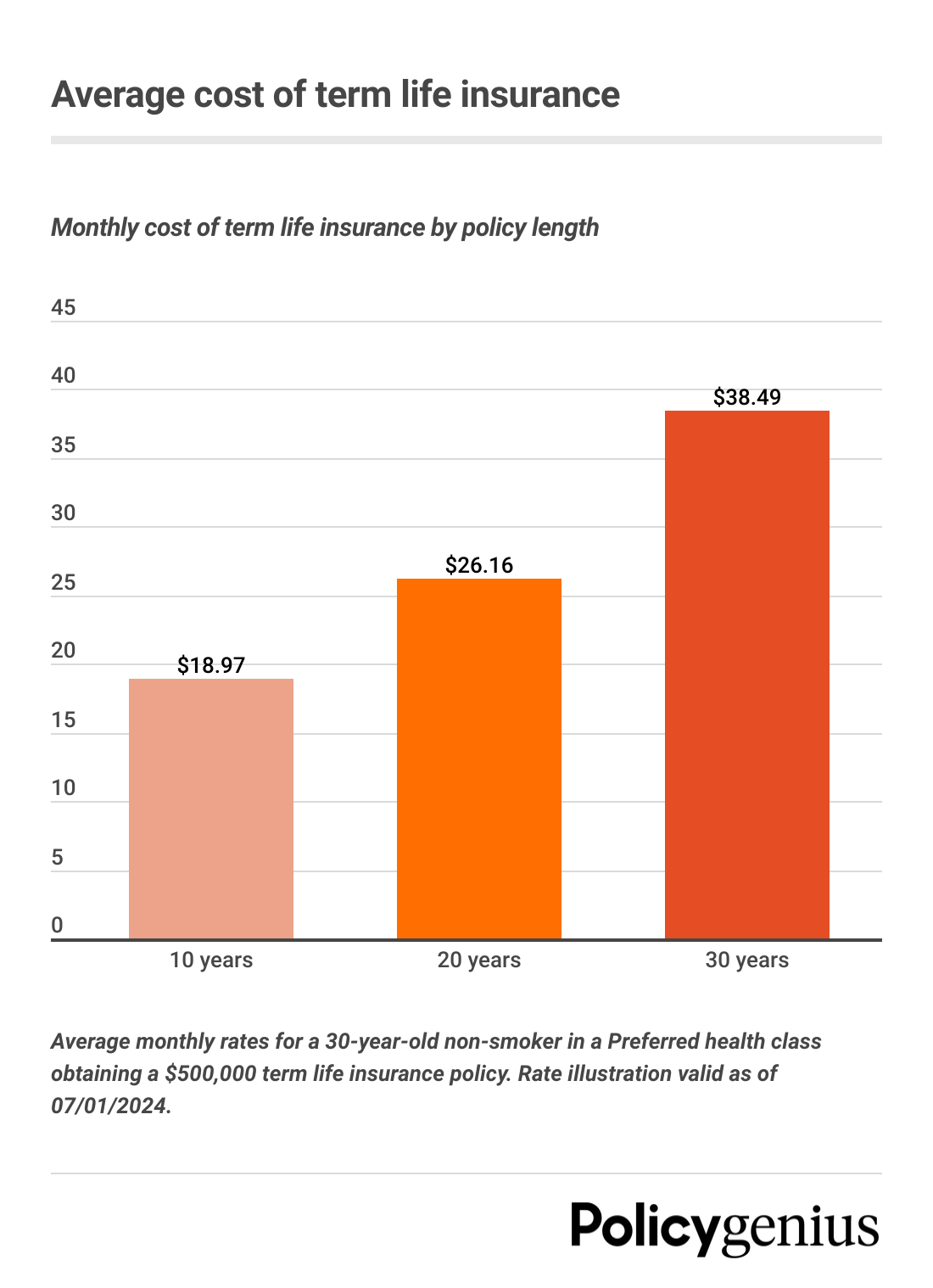

Currently term insurance policy rates are very affordable and among the cheapest historically experienced. It needs to be kept in mind that it is a widely held idea that term insurance is the least costly pure life insurance coverage available. One requires to evaluate the policy terms meticulously to decide which term life alternatives appropriate to fulfill your certain circumstances.

With each brand-new term the costs is raised. The right to restore the policy without evidence of insurability is an important advantage to you. Or else, the risk you take is that your health might degrade and you may be incapable to get a plan at the exact same rates or perhaps at all, leaving you and your beneficiaries without protection.

The length of the conversion period will certainly differ depending on the kind of term plan bought. The premium price you pay on conversion is normally based on your "existing attained age", which is your age on the conversion day.

How do I cancel Fixed Rate Term Life Insurance?

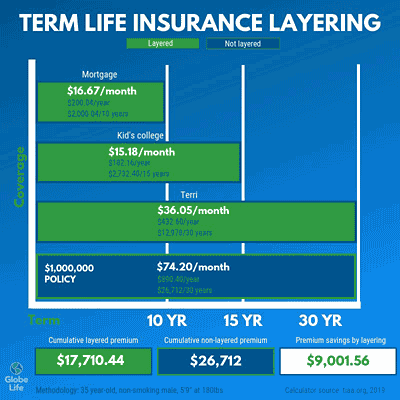

Under a level term policy the face quantity of the plan stays the very same for the whole period. Usually such policies are marketed as home loan security with the amount of insurance coverage lowering as the equilibrium of the home mortgage reduces.

Generally, insurance firms have actually not had the right to alter costs after the policy is sold. Given that such plans might proceed for years, insurance companies should utilize conventional mortality, interest and cost price price quotes in the premium computation. Flexible costs insurance policy, however, enables insurers to supply insurance policy at lower "existing" premiums based upon less conventional assumptions with the right to alter these premiums in the future.

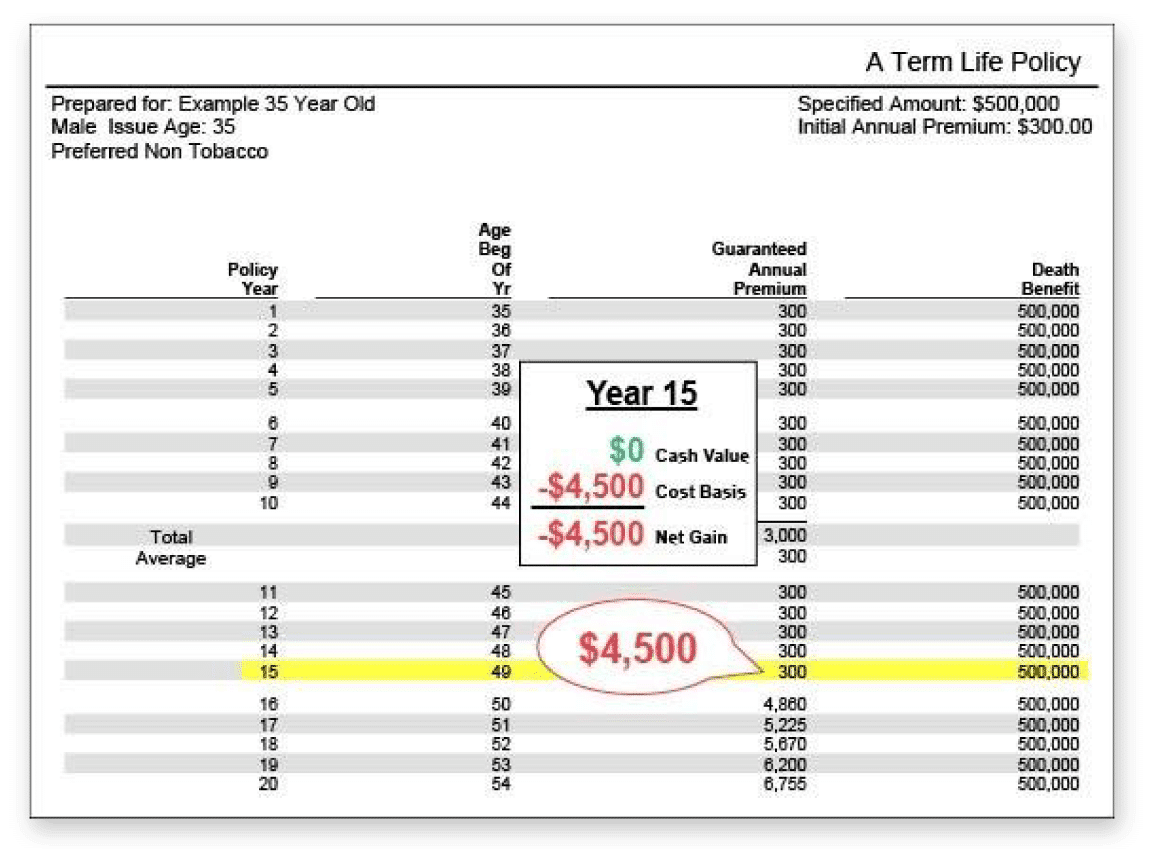

While term insurance is made to offer protection for a specified period, irreversible insurance coverage is designed to offer insurance coverage for your entire lifetime. To keep the premium rate degree, the costs at the younger ages goes beyond the real cost of protection. This added premium develops a book (cash money worth) which aids pay for the policy in later years as the expense of defense increases over the costs.

Level Term Life Insurance Protection

With degree term insurance policy, the expense of the insurance will remain the exact same (or possibly decrease if returns are paid) over the regard to your plan, generally 10 or twenty years. Unlike permanent life insurance coverage, which never ends as lengthy as you pay premiums, a degree term life insurance plan will end at some point in the future, typically at the end of the duration of your level term.

As a result of this, lots of people use irreversible insurance policy as a secure economic preparation tool that can serve several demands. You may be able to transform some, or all, of your term insurance policy during a set duration, normally the first one decade of your policy, without needing to re-qualify for insurance coverage even if your wellness has actually transformed.

What does Level Term Life Insurance For Families cover?

As it does, you may want to contribute to your insurance policy protection in the future. When you initially obtain insurance policy, you may have little savings and a big mortgage. Ultimately, your financial savings will certainly grow and your mortgage will certainly reduce. As this takes place, you might desire to eventually reduce your survivor benefit or think about transforming your term insurance policy to a long-term policy.

So long as you pay your premiums, you can rest easy understanding that your liked ones will certainly obtain a survivor benefit if you die throughout the term. Lots of term plans permit you the ability to convert to long-term insurance coverage without having to take an additional health and wellness exam. This can permit you to take advantage of the fringe benefits of a permanent policy.

Table of Contents

- – What is the process for getting Level Term Lif...

- – What is the best Affordable Level Term Life In...

- – What does Level Term Life Insurance cover?

- – How do I get Level Term Life Insurance Premiums?

- – How do I cancel Fixed Rate Term Life Insurance?

- – Level Term Life Insurance Protection

- – What does Level Term Life Insurance For Fami...

Latest Posts

All Life Funeral

Whole Life Insurance Online Instant Quote

Life Insurance Quotes Instant

More

Latest Posts

All Life Funeral

Whole Life Insurance Online Instant Quote

Life Insurance Quotes Instant