Featured

Table of Contents

Life insurance policy provides 5 economic advantages for you and your family. The major advantage of adding life insurance policy to your economic strategy is that if you pass away, your successors get a lump sum, tax-free payment from the policy. They can use this money to pay your final expenditures and to change your earnings.

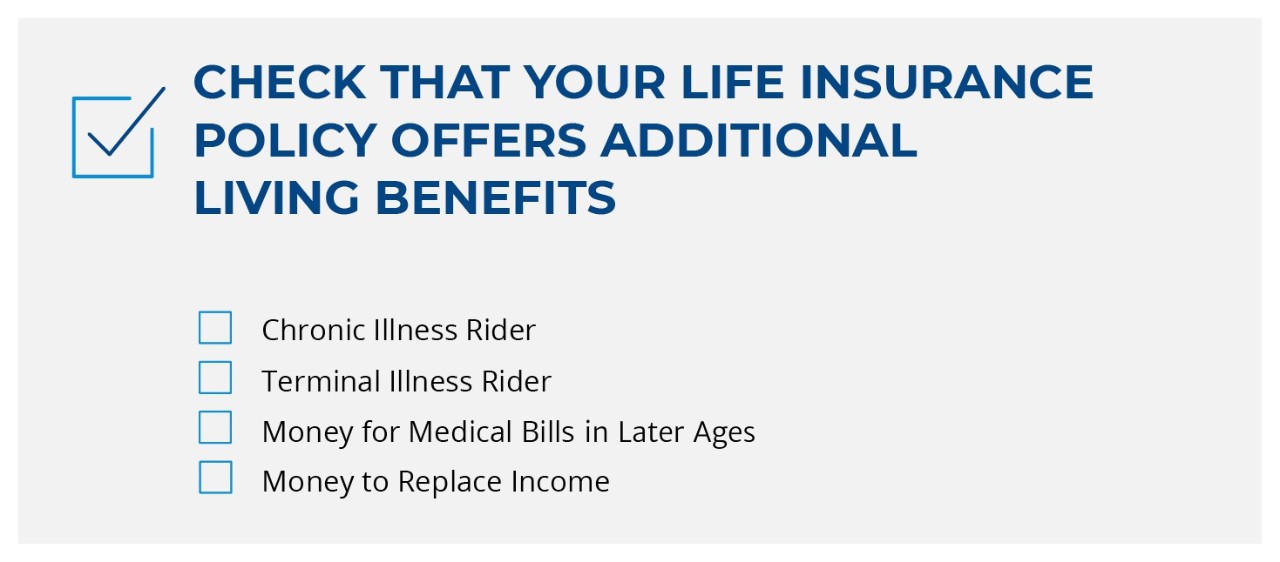

Some policies pay if you establish a chronic/terminal ailment and some provide savings you can utilize to support your retirement. In this post, discover about the various advantages of life insurance policy and why it might be a great idea to purchase it. Life insurance policy uses benefits while you're still alive and when you pass away.

What is the difference between Cash Value Plans and other options?

Life insurance policy payments usually are income-tax free. Some irreversible life insurance coverage plans build cash worth, which is cash you can take out while still active.

If you have a policy (or plans) of that dimension, the people who depend on your income will certainly still have money to cover their ongoing living expenses. Recipients can utilize plan benefits to cover essential daily expenditures like rent or home loan repayments, utility costs, and groceries. Average yearly expenses for homes in 2022 were $72,967, according to the Bureau of Labor Statistics.

Life insurance payouts aren't thought about earnings for tax obligation functions, and your recipients do not have to report the cash when they submit their tax returns. Depending on your state's regulations, life insurance coverage benefits might be utilized to balance out some or all of owed estate taxes.

In addition, the cash money value of entire life insurance expands tax-deferred. As the cash money worth develops up over time, you can use it to cover costs, such as buying a car or making a down payment on a home.

How does Term Life work?

If you decide to borrow against your money worth, the loan is not subject to earnings tax obligation as long as the plan is not given up. The insurance provider, nevertheless, will certainly charge interest on the lending amount till you pay it back. Insurer have varying rates of interest on these fundings.

For instance, 8 out of 10 Millennials overestimated the cost of life insurance policy in a 2022 research study. In truth, the average price is more detailed to $200 a year. If you believe buying life insurance policy might be a wise economic action for you and your family members, think about consulting with a monetary expert to embrace it into your monetary strategy.

What should I know before getting Accidental Death?

The five main sorts of life insurance policy are term life, whole life, universal life, variable life, and last cost insurance coverage, additionally referred to as funeral insurance. Each type has different attributes and benefits. Term is extra economical however has an expiry day. Entire life begins costing extra, but can last your whole life if you maintain paying the premiums.

Life insurance coverage might additionally cover your home loan and provide cash for your family members to keep paying their expenses. If you have family members depending on your revenue, you likely need life insurance policy to sustain them after you pass away.

Lesser amounts are offered in increments of $10,000. Under this plan, the chosen insurance coverage takes impact two years after registration as long as costs are paid throughout the two-year duration.

Protection can be extended for up to two years if the Servicemember is entirely handicapped at separation. SGLI insurance coverage is automatic for most active responsibility Servicemembers, Ready Book and National Guard participants arranged to execute at least 12 durations of inactive training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Management and the Public Wellness Service, cadets and midshipmen of the U.S.

VMLI is available to Readily available who received that Obtained Adapted Particularly Adjusted Real EstateGive), have title to the home, and have a mortgage on home mortgage home. All Servicemembers with full time insurance coverage ought to make use of the SGLI Online Enrollment System (SOES) to mark beneficiaries, or reduce, decrease or restore SGLI protection.

Members with part-time protection or do not have access to SOES ought to use SGLV 8286 to make adjustments to SGLI (Riders). Complete and data kind SGLV 8714 or make an application for VGLI online. All Servicemembers must make use of SOES to decline, decrease, or bring back FSGLI protection. To accessibility SOES, most likely to www.milconnect.dmdc.osd.mil/milconnect/. Participants that do not have access to SOES need to utilize SGLV 8286A to to make changes to FSGLI protection.

What does a basic Flexible Premiums plan include?

Plan advantages are decreased by any type of impressive loan or loan passion and/or withdrawals. If the plan lapses, or is surrendered, any outstanding lendings considered gain in the policy might be subject to ordinary income tax obligations.

If the plan proprietor is under 59, any taxed withdrawal may likewise be subject to a 10% government tax charge. All entire life insurance plan assurances are subject to the timely settlement of all needed costs and the claims paying capacity of the issuing insurance coverage business.

The money abandonment worth, financing worth and fatality earnings payable will certainly be reduced by any type of lien impressive because of the repayment of a sped up benefit under this motorcyclist. The sped up advantages in the initial year reflect reduction of a single $250 management fee, indexed at a rising cost of living price of 3% annually to the price of velocity.

A Waiver of Costs rider waives the obligation for the insurance policy holder to pay further premiums must he or she become completely impaired continuously for at least 6 months. This biker will incur an added cost. See plan contract for extra information and requirements.

Who provides the best Universal Life Insurance?

Discover more concerning when to get life insurance policy. A 10-year term life insurance policy plan from eFinancial prices $2025 per month for a healthy and balanced grownup who's 2040 years old. * Term life insurance policy is extra inexpensive than long-term life insurance policy, and female consumers generally obtain a reduced rate than male consumers of the same age and health standing.

Latest Posts

All Life Funeral

Whole Life Insurance Online Instant Quote

Life Insurance Quotes Instant